Share:

The article concentrates on the overview and establishment of representative offices of foreign enterprises in Vietnam.

Establishing a representative office (“RO”) is one of the options which be chosen by foreign enterprises to penetrate the market in Vietnam. This is a suitable choice to save time and costs in case foreign enterprises would like to approach the Vietnamese market through activities such as market research and promotion of investment activities. The following shall give readers a briefing of RO in Vietnam especially pursuant to Commercial Law No. 36/2005/QH11 dated 14 June 2005 (“Commercial Law”) and Decree No. 07/2016/ND-CP dated 25 January 2016 regarding detailed regulations on establishment of representative offices or branches of foreign traders in Vietnam under Commercial Law (“Decree 07/2016”).

A. OVERVIEW

1. Who is allowed to establish RO in Vietnam?

RO means a dependent unit of the parent company which has the function of conducting the market survey and some commercial promotion activities permitted by Vietnamese laws[1].

There is a fact that not all foreign enterprises may set up a RO in Vietnam but to satisfy certain requirements to be eligible[2]:

Firstly, only foreign enterprise incorporated and registering for doing business in either countries, territories being parties to treaties to which Vietnam is a signatory or in those recognized by the aforesaid countries or territories shall be considered for granting the establishment licenses of RO.

Secondly, the foreign enterprise must be in operation for at least 01 year in its country from the date of establishment or registration. In case its operation term in Certificate of Business Registration or equivalent document, from the date of submission of RO’s application, the term must be at least 01 more year.

Finally, the operation scope of RO is consistent with that Vietnam’s Commitments to treaties to which Vietnam is a signatory. If not, it requires the approval of relevant Ministers or Heads of ministerial agencies on a case-by-case basis.

2. What is RO allowed to do and NOT to do?

Unlike a branch of a foreign enterprise in Vietnam, RO has much fewer functions. RO is not allowed to conduct the profit-generating activities or enter into contracts or amend or supplement contracts executed by its parent company except where there is a valid authorization.

RO is only permitted to engage in the commercial promotion activities: (i) operating as a liaison office for its parent company; (ii) conducting market research; and (iii) promoting the businesses of its parent company in Vietnam.

3. How many ROs a foreign enterprise can be established in Vietnam?

There is no limitation on how many ROs that a foreign enterprise may establish in Vietnam. However, within a province or centrally-affiliated city, each foreign enterprise is not entitled to set up more than one RO that has the same name[3].

4. Is it compulsory to have physical workspaces?

Foreign enterprises can rent virtual offices or shared offices or physical workspaces to serve as the address of RO to suit their business. However, the location must be within Vietnam’s territory, which usually consists of a house number, street, commune, district and province. At the same time, it must conform to the provisions on security conditions, order and hygiene and other conditions as prescribed by law.

It is noted that if a RO's address is located in a mixed-purpose area such as a building, the function of the apartment herein must be commercial purposes as an office. So, please keep this in mind when searching for a place and entering into a lease agreement.

5. Can the foreigner be appointed as the head of RO?

The organization structure and personnel of RO is at the discretion of foreign enterprise. The head of RO may be either a Vietnamese citizen or a foreigner. In order to work lawfully in Vietnam, expats, including the chief RO and employees, must apply for a work permit. The head of RO shall not concurrently hold the following titles[4]:

- The head of a branch of the same foreign enterprise;

- The head of a branch of another foreign enterprise;

- The legal representative of the same or different foreign enterprise; or

- The legal representative of a business organization incorporated in accordance with laws of Vietnam.

In case RO violates the above regulations, it shall be fined ranging from 20 million to 30 million Vietnamese Dong and its establishment license may be suspended up to 03 months[5].

6. Does the RO incur tax liabilities?

Since the RO does not perform business activities, corporate income tax is not incurred. For personal income tax, RO is responsible for declaring, deducting tax from employee salaries, paying tax, and finalizing personal income tax for employees working at RO.

To sum up, the above are the first guidelines to establish a RO in Vietnam. Foreign investor needs to take notes and comply with regulations to reduce risks and save time in the process of RO establishment.

B. ESTABLISHMENT

Under Vietnamese laws, there are two agencies that have the authority to issue an establishment license for RO. They are, the provincial Department of Industry and Trade (the "DOIT") and Management Boards of industrial parks, export-processing zones, economic zones or hi-tech zones (the "Management Boards").

Depending on where a RO is expected to be located, either of the above shall be responsible for the consideration and issuance of a RO's license. Accordingly, in case the RO's location is outside industrial parks, export-processing zones, economic zones or hi-tech zones, DOIT is the competent authority to handle it, otherwise it is under the authority of the Management Boards.

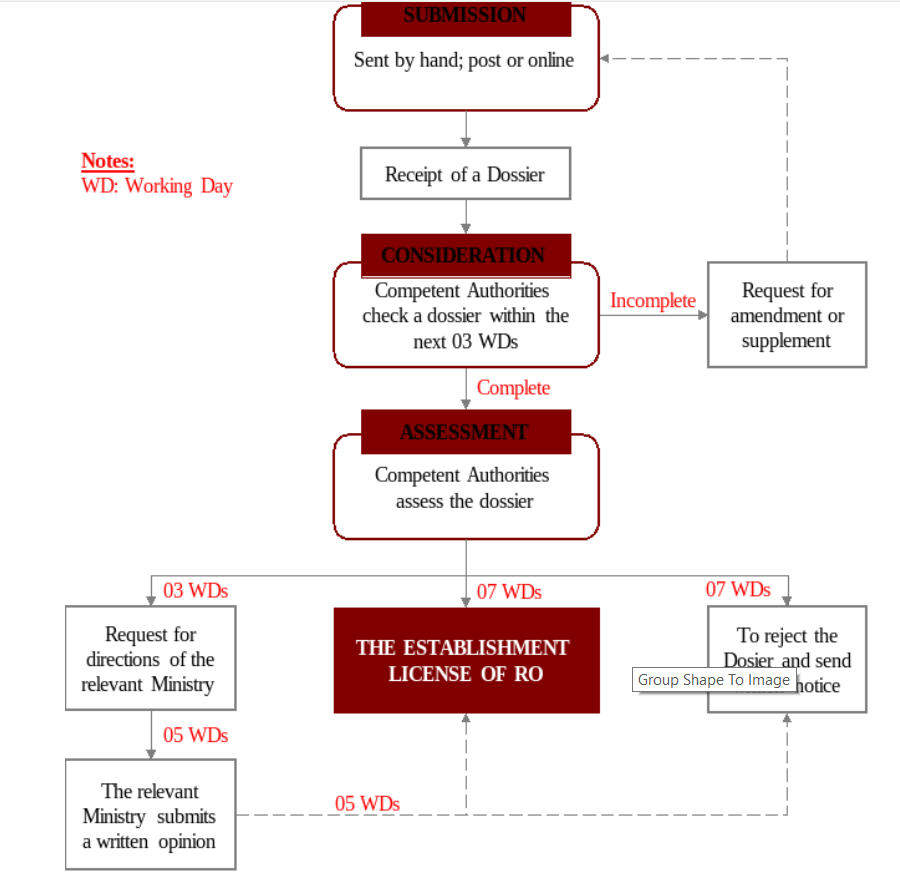

Pursuant to Decree 07/2016, it only takes around 10 working days from the date of receipt of the valid application for the issuance of a license. In case it is necessary to seek for directions from relevant Ministry, such time could be longer but not later than 16 working days. From our experience, there is not much difference between statutory time and practice.

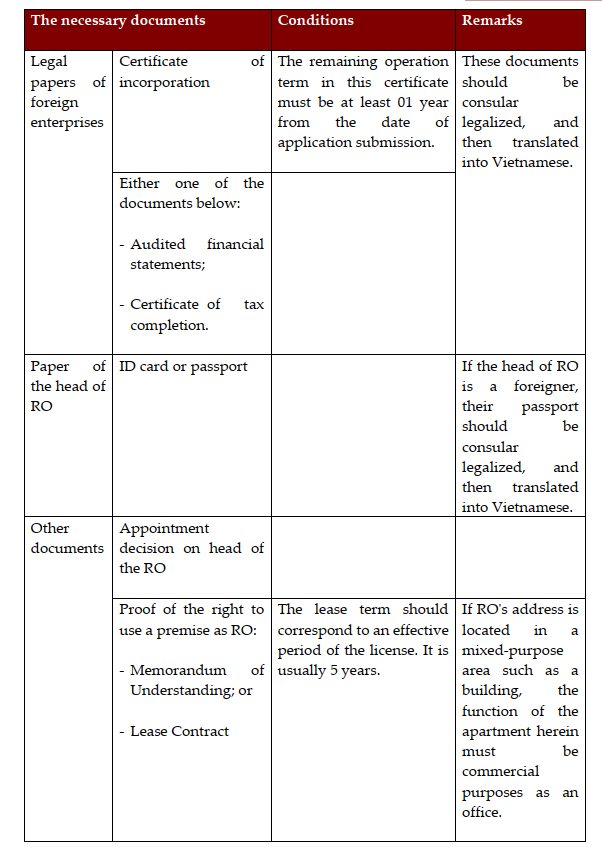

As for the application, the required documents are as follows:

The procedure provided in Article 11 of Decree 07/2016/ND-CP is summarized below:

[1] Clause 6 Article 3 of Commercial Law.

[2] Article 7 of Decree 07/2016.

[3] Clause 2 Article 3 of Decree 07/2016.

[4] Article 33 of Decree 07/2016.

[5] Clause 3, Clause 5 Article 67 of Decree No. 98/2020/ND-CP dated 26 August 2020 prescribing penalties for administrative violations against regulations on commerce, production and trade in counterfeit and prohibited goods, and protection of consumer rights.

***

We hope you find our articles interesting and useful in your everyday business operations. We wish you pleasant reading. Please kindly visit Insight at our official website www.bizlegalgroup.com for more.