Share:

The article concentrates on the payment for capital transfer of FIEs between non-residents and residents.

Capital transfer relating to foreign investment activities are strictly managed by the Government under the regulations on foreign exchange management. In particular, transactions related to contribution of capital, transfer of capital contribution or shares... in foreign-invested enterprises (“FIEs”) have been receiving serious attention. The State Bank of Vietnam’s issuance of Circular No. 06/2019/TT-NHNN (“Circular 06”) on 26 June 2019, being effective from 06 September 2019, demonstrates significant changes in the current regulatory framework governing foreign exchange in direct investment activities in Vietnam.

The most popular forms of foreign investment in Vietnam are contribution of capital, or transfer of shares or capital contributions in enterprises. For the purpose of this article, we only refer to transactions of share or capital contribution transfer in unlisted companies (“Capital Transfer”).

Direct investment capital accounts (“DICA”)

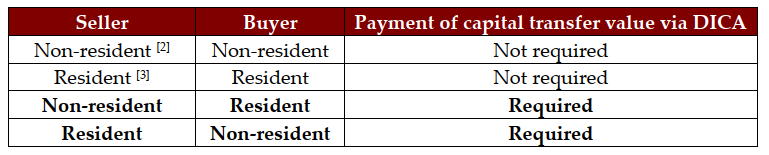

Under Circular 06, the payment of capital transfer value at FIEs shall be conducted based on investor's residency criteria, namely[1]:

To be able to determine which payments can be conducted via DICA, we need to clarify the definition of FIEs in Circular 06. In the scenario of the Capital Transfer, FIEs mean:

(a) enterprises which are established by foreign investors as shareholders or members (with or without local partners) and are required to carry out procedures for grant of investment registration certificates;

In this case, the FIEs must open DICA upon receipt of capital contribution from foreign investors.

(b) enterprises which do not fall under definition at (a) but has from 51% of their charter capital owned by foreign investors;

Before the Capital Transfer, FIEs may be local enterprises without foreign investors or enterprises that have below 51% foreign ownership. Foreign investors shall conduct procedures for investment in the form of capital contribution or purchase of shares or capital contributions in case the Capital Transfer leads to the increase foreign investors’ charter capital holding rate to over 50% for grant of official notices on satisfaction of conditions for foreign investor to conduct capital contribution, transfer of shares or capital contribution (“M&A Approvals”). Authorized banks (DICA banks) shall accept for FIEs to open DICA when FIEs are granted relevant M&A Approvals.

FIEs shall close their previous DICA in the event the percentage of charter capital of such enterprises owned by foreign investors is below 51%. In this case, foreign investors as non-residents owning capital in such enterprises shall then have to open indirect investment capital accounts (IICA) to conduct revenue and expenditure transactions under regulations on foreign exchange management for foreign indirect investment activities in Vietnam[4].

Capital Transfer Value

M&A Approvals is not a new requirement, it has existed since the previous versions of the Law on Investment but coming to Law on Investment No. 61/2020/QH14 dated 17 June 2020 taking effect from 01 January 2021, M&A Approvals are added with a new content of “Estimated transaction value of contract of capital contribution/share purchase/capital contribution purchase” (in Vietnamese: “Giá trị giao dịch dự kiến của hợp đồng góp vốn/mua cổ phần/mua phần vốn góp”) ("Estimated Value") in VND and in USD (equivalent). In respect of State management of foreign exchange, such addition can be one of the tools to help the State authorities control transactions with foreign factor. However, it may cause difficulties for the investors and FIEs in making payment of capital transfer value via DICA, including difficulties from DICA banks that we will discuss below.

Although M&A Approvals only refer to the Estimated Value which means that the investors still have the right to negotiate the final capital transfer value after the issuance of M&A Approvals, many banks hold the opinion that the Estimated Value is an official and binding milestone. Therefore, the investors are not allowed to remit the capital transfer value more than the Estimated Value as stated in the M&A Approvals via DICA without any legal ground for this view.

For the avoidance of interference and interruption, the FIEs and the investors should clearly discuss with DICA banks about their understanding in advance before opening DICA.

One way the investors could unclog this difficulty is to declare the Estimated Value higher than the agreed capital transfer value when the submission for M&A Approvals. It will neither adversely affect the transaction nor the parties' intention to enter into the transaction because the M&A approvals are non-binding.

Cash flow

Regardless of foreign direct or indirect investment activities in Vietnam, the pricing and payment of capital transfer value between residents and non-residents shall be conducted in VND.

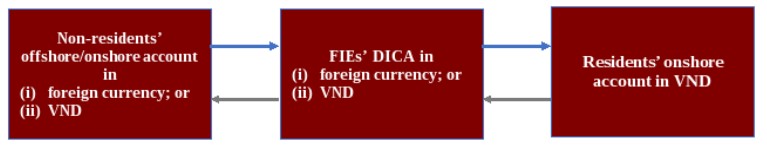

The diagram below indicates the cash flow of payments in the scenario of the transfer of capital in FIEs between non-residents and residents[5]:

As mentioned above, the Estimated Value stated in M&A Approvals is shown by default under 02 currencies, in VND and in USD (equivalent). Based on the reasonable explanation of the investors, there are still cases where the Department of Planning and Investment may allow converting the Estimated Value into other foreign currency than USD (the banks may accept to open DICA in such currency). However, in most cases, DICA to receive capital transfer value will be opened in default currency (USD or VND).

Because the authorized banks may not agree to open DICA in a currency different from the ones stated in the M&A Approvals and not all investors are from countries and territories using USD as the official currency, the FIEs and the investors need to work with the DICA banks to clear the cash flow for the transaction.

For example: A Singapore investor (using SGD) but DICA opens in VND (based on M&A Approvals), for payment of capital transfer value, the investor needs to (i) buy VND from a bank for making payment directly to DICA, or (ii) transfer SGD to DICA, and this transfer transaction will be suspended until DICA bank converts SGD amount into VND amount at the applicable exchange rate and credits VND amount to DICA.

[1] Article 10 of Circular 06.

[2] Clause 3 Article 4 of Ordinance on Foreign Exchange Control No. 28/2008/PL-UBTVQH11.

[3] Clause 2 Article 4 of Ordinance on Foreign Exchange Control No. 28/2008/PL-UBTVQH11 amended and supplemented by Ordinance No. 06/2013/UBTVQH13.

[4] Clause 6 Article 5 of Circular 06.

[5] Article 6, Article 7 of Circular 06.

***

We hope you find our articles interesting and useful in your everyday business operations. We wish you pleasant reading. Please kindly visit Insight at our official website www.bizlegalgroup.com for more.